Colorado Springs Real Estate: 2023 in Review

As we reflect on the 2023 real estate market, it was a year marked by notable shifts and adjustments. The year was initially buoyant from the pandemic-driven surge, and then it began to normalize, balancing out the high demand and low inventory issues we saw in the previous years.

As the year progressed and interest rates started creeping up, buyer behavior adjusted and home sales slowed. This change led to a more stable and predictable market, with price growth moderating and homes taking longer to sell compared to the frenzied pace of 2021 and 2022.

The adjusted market allowed more decisions to be more thoughtful and calculated and less hurried which was a welcome change!

Home Value

The Pikes Peak area Home Value has enjoyed a 161% increase since 2003, with an annual appreciation of 5.9%. Even as the market has slowed this year, it is important to understand we have moved to market of deceleration – not a depreciating market. We are living in the 14th top housing market in the US, and experts predict a home appreciation next year of 6.74%.

Homes in our area hold their value well, largely because of the strong military presence, quality of life, and opportunities. More employers are moving here and we currently have 7 companies bringing 2,300 well paying jobs to our community.

New listings in October were 1,185 where in October 2022 it was 1,467, and the Total sales YTD 2023 10,252 where in Oct. 2022 it was 13,625. The average sales price in Oct was $556,964 and Oct '22 it was $535,404 while the Days on Market was 45 which is below the Historical Average of 57.

What is affecting the housing market right now and the ability to buy a home

There are three critical factors that create a three legged stool that impact the ability for many buyers to purchase a home. This equation is made up of:

-

- Home Price

- Income

- Mortgage Rate

What does AFFORDABILITY mean?

Housing affordability refers to the how people can reasonably cover the costs associated with securing a place to live, relative to their income. purchase price of a home, but also the ongoing expenses like mortgage payments, property taxes, insurance, maintenance, and utilities. The recommended threshold not more than 25 - 30% of a household income.

As home value has appreciated AND interest rates have also increased, affordability decreases for many. This has impacted the rate that homes are being sold, and causing many to wait on their next move.

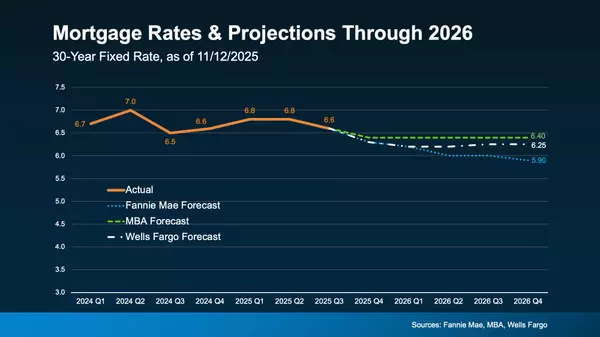

Should I Wait for interest rates to go down?

Here is some perspective for those who say they want to wait until prices go down:

In 1971, interest rates were 7.33%. If you waited for rates to go down, you would’ve waited until 1993 and would have rented for 22 years. During this same time period, the value of RE quadrupled !

Suggestions for Home Buyers to consider:

-

- Consider New Construction – many builders are offering great incentives that we haven’t seen for years

- Innovative loan programs – such as rate buy downs and down payment assistance

- VA Assumable loans – allow the assumption of a loan and low interest rate to a Buyer

- Multigenerational housing – becoming more popular for many reasons

Homeownership provides financial stability, security, and community. It allows a predictable monthly mortgage payment and is great way to build wealth.

Home Ownership helps people gain financial freedom and a Home owner has an average of 40 times more net worth than a renter does.

Real estate continues to be a great way to diversify and, over time, still outperforms other investment options. It is time to gather your team of trusted advisors including your

financial planner, realtor, and a lender to help you create a financial and wealthy building strategy for 2024!

cell 719.238.0330 office 719.536.4444

Marquesa@ColoradoHearthstone.com

6760 Corporate Drive, Ste. 300 | Colorado Springs, CO 80919

Categories

Recent Posts

GET MORE INFORMATION