Momentum Is Building: Why 2026 Homebuyers in Colorado Springs Should Start Preparing Now

Quietly but steadily, momentum is returning to the housing market — and buyers are starting to feel it. New data from NerdWallet shows more Americans are beginning to think seriously about homeownership again. Last year, 15% of respondents said they planned to buy a home within the next 12 months.

Selling Your Colorado Springs or Monument Home: What Successful Sellers Already Know

If you’re thinking about selling your home in Colorado Springs, Monument, or the surrounding Northern El Paso County communities, here’s one thing you should know: the homeowners who win in today’s market aren’t the ones sitting back, waiting for the “perfect” moment. They’re the ones who adapt earl

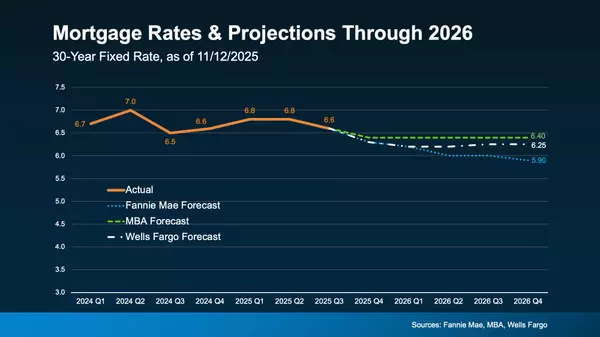

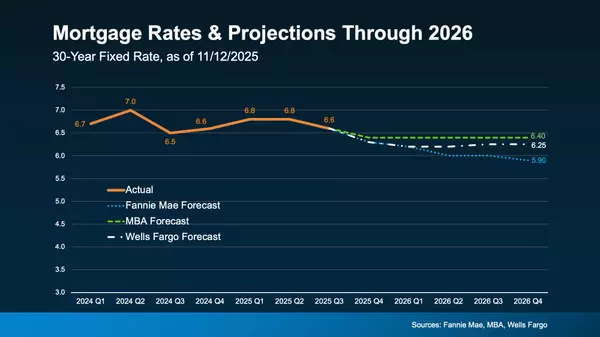

Why Waiting for Mortgage Rates to Hit the 5s May Cost You More in Colorado Springs & Monument

Many home buyers in the Pikes Peak area are actively watching mortgage rates hover just above 6% and thinking, “I’ll buy when rates hit the 5s.” While it seems like a good idea, as who wouldn’t want a lower rate, it actually may not work as you planned.Waiting for 5.99% may not save you as much as y

Categories

Recent Posts