Are Investors Actually Buying Up All the Homes?

Are you trying to buy a home but you feel like you’re up against deep-pocketed Wall Street investors snatching up everything in sight? Many people believe mega investors are driving up prices and buying up all the homes for sale, and that’s making it hard for regular buyers like you to compete. But

Do You Know How Much Your Home Is Worth?

Over the past few years, you’ve probably seen a whole lot of headlines about how home prices keep going up. Have you stopped to think about what that actually means for your home? Home prices have risen dramatically over the past five years — far more than usual. And if selling has been on your mind

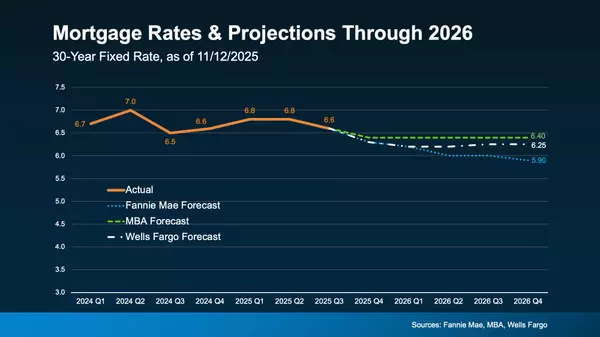

Real Estate & Housing with New Administration in 2025

As the new administration takes office, there is considerable focus on economic policies, particularly in the realm of housing. President Trump has outlined several economic goals to lower the cost of living and improve home affordability. Here's a snapshot of housing policy proposals and their poss

Categories

Recent Posts