Time in the Market Beats Timing the Market

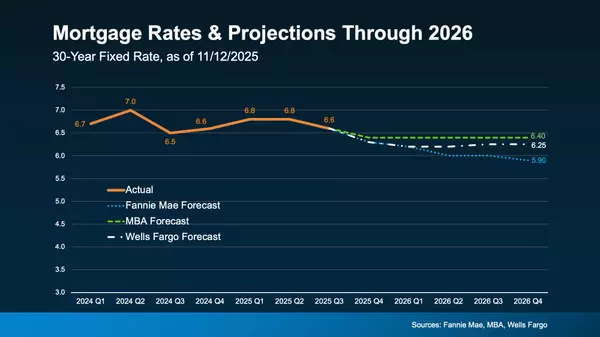

Trying to decide whether it makes more sense to buy a home now or wait? There’s a lot to consider, from what’s happening in the market to your changing needs. But generally speaking, aiming to time the market isn’t a good strategy – there are too many factors at play for that to even be possible. Th

What Will It Take for Home Prices To Come Down?

You may be wondering if home prices are going to crash. And believe it or not, some people might even be hoping this happens so they can finally purchase a more affordable home. But experts agree that's not what's in the cards – here is what they say: There are more people who want to buy a home th

Struggling To Sell Your House? Read This.

When you sell your house, ideally, you want it to go something like this: your house sells for top dollar, you get it sold quickly, and it all goes down without a hitch. But what many people don’t realize is that even in today's market where there are more buyers than homes for sale, there are still

Categories

Recent Posts