Do You Know How Much Your Home Is Worth?

Over the past few years, you’ve probably seen a whole lot of headlines about how home prices keep going up. Have you stopped to think about what that actually means for your home? Home prices have risen dramatically over the past five years — far more than usual. And if selling has been on your mind

Smaller Homes, Bigger Opportunities: The Homebuilder Trend Buyers Love

It’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. But, if you don’t need a ton of space, you may find you have more cost-effective options in an unexpected place: new home communit

Real Estate & Housing with New Administration in 2025

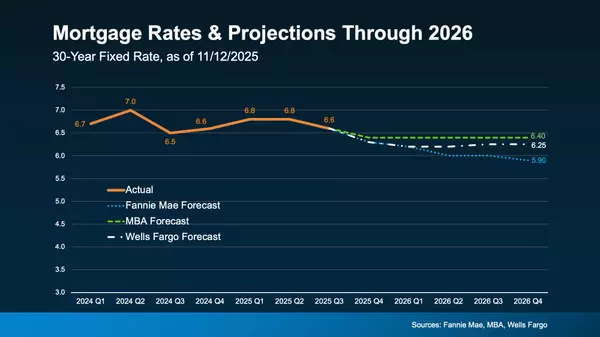

As the new administration takes office, there is considerable focus on economic policies, particularly in the realm of housing. President Trump has outlined several economic goals to lower the cost of living and improve home affordability. Here's a snapshot of housing policy proposals and their poss

Categories

Recent Posts