Real Estate Market Update for January 2026: What Buyers and Sellers Need to Know Now

As we close out 2025 and move into 2026, the real estate market is sending a clear message: things are normalizing. That doesn’t mean the market is easy — but it does mean it’s becoming more balanced, more predictable, and more strategic.

Both buyers and sellers are navigating a very different landscape than we saw during the pandemic boom, and understanding today’s conditions is key to making smart decisions moving into 2026.

Renting vs. Buying: Why the Monthly Cost Can Be Misleading

Nationally, renting is currently cheaper than owning a home on a month-to-month basis in many of the largest U.S. metro areas. Higher mortgage rates, increased property taxes, rising maintenance costs, and significantly higher homeowners insurance premiums have all contributed to the higher cost of ownership.

Because of this, renting can feel like the safer or easier option right now — and for some households, it truly is the right short-term choice.

However, there’s an important long-term truth to remember: everyone who lives indoors pays a mortgage. The question is whether you’re paying your own mortgage and building equity, or paying someone else’s.

Affordability Is Improving — Slowly, But Meaningfully

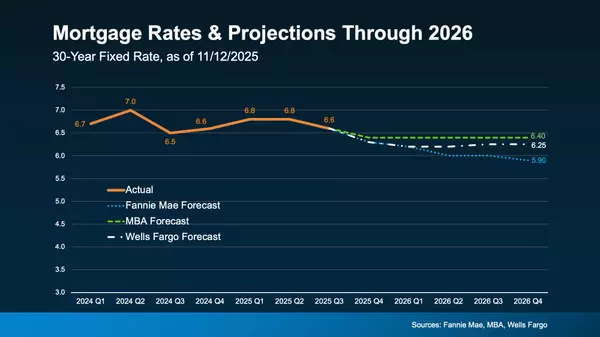

While affordability remains a challenge, the trend is moving in the right direction. Recent data shows affordability improving across most major U.S. markets, with buyer conditions reaching their strongest point in nearly three years.

Mortgage payments have eased from earlier peaks, inventory has increased, and buyers are regaining negotiation power. This isn’t a return to “cheap housing,” but it is a return to balance — and that shift matters.

For buyers who have been watching from the sidelines, these changes create opportunity.

The Biggest Affordability Myth: You Don’t Need 20% Down

One of the most common misconceptions I hear is that buyers must put 20% down to purchase a home. That simply isn’t true.

Many buyers qualify with as little as 3–5% down, depending on the loan program. Waiting years to save 20% often means missing out on appreciation and equity growth along the way. Education, not fear, is what opens the door to homeownership in today’s market.

Why Homeownership Still Builds Wealth Over Time

Data consistently shows that homeowners who stay in their homes long enough tend to see equity gains exceed their total cost of ownership — even when factoring in taxes, insurance, and maintenance.

As home values rise over time, equity helps offset ongoing costs. In strong appreciation years, that equity can dramatically reduce the true cost of owning a home. Renting may offer flexibility, but homeownership remains one of the most powerful long-term wealth-building tools available.

What This Means Locally in the Pikes Peak Region

Here in the Pikes Peak area, the market is following a healthy normalization pattern:

-

Inventory levels are higher and closer to pre-pandemic norms

-

Days on market have returned to average levels, signaling balance rather than urgency

-

Homes are still selling, but buyers are negotiating more

-

Price-to-list ratios remain strong, showing realistic pricing matters

-

Builders are offering incentives and price adjustments, creating additional buyer leverage

This is no longer a rush market — it’s a strategy market.

Key Takeaways for Buyers and Sellers

For Buyers:

Affordability is improving, inventory is up, and negotiation power has returned. Buyers who are informed, financially prepared, and working with an experienced local agent are in a strong position right now.

For Sellers:

Homes are still selling, but pricing, presentation, and marketing matter more than they have in years. Sellers who price strategically and partner with an experienced professional are the ones who succeed — the rest risk sitting on the market.

Looking Ahead to 2026

As we move into the new year, clarity will be the advantage. The buyers and sellers who understand today’s market — and adjust their strategy accordingly — will be best positioned for success.

If you’re considering a move, now is the time to get informed, ask questions, and create a plan that fits both the market and your long-term goals.

What’s important to note is that the slowdown you see in the orange bars on this graph wasn’t simply A Top Realtor, Marquesa Hobbs, is ready to help you whether you are buying or selling Real Estate!

cell 719.238.0330 office 719.536.4444

Categories

Recent Posts

GET MORE INFORMATION