What’s Really Happening with Mortgage Rates?

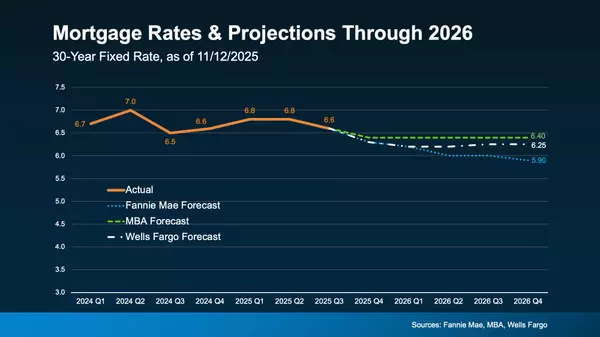

Are you feeling a bit unsure about what’s really happening with mortgage rates? That might be because you’ve heard someone say they’re coming down. But then you read somewhere else that they’re up again. And that may leave you scratching your head and wondering what’s true. The simplest answer is: t

Don’t Let the Latest Home Price Headlines Confuse You

Based on what you’re hearing in the news about home prices, you may be worried they’re falling. But here’s the thing. The headlines aren’t giving you the full picture. If you look at the national data for 2023, home prices actually showed positive growth for the year. While this varies by market, an

Achieve Your Dream of Homeownership with Condos and Townhomes

Some Highlights If you’re trying to buy a home but are having a hard time finding something in your budget, here’s something that can help: consider condos and townhomes. They may better fit your budget, can help you start building equity, and tend to require minimal upkeep and less maintenance. Loo

Categories

Recent Posts